16 Which One of the Following Is a Direct Tax

A 20 final withholding tax on interest income on bank deposits and a 5 gross receipts tax on banks is a direct duplicate taxation. Which among the following is a direct tax.

Income Tax Update For Non Verified Itr Income Tax Return Income Tax Income Tax Return Filing

A firms capital structure is independent of its need for external funding.

. Which one of the following has the greatest tendency to increase the percentage of debt included in the optimal capital structure of a firm. A direct tax is a tax imposed upon a person or property. This is a Most important question of gk exam.

Options is. This Act introduced first the concept of aggregating incomes under different. The basic community tax of P5 of an individual is a an A.

Substantial tax shields from other sources D. Firms stockpile internally generated cash. A direct tax is understood as a government levy on the income property or wealth of people or companies.

Which one of the following is a direct tax. The main examples of Direct Taxes are Income. A 50 percent decrease in the par value per.

Though ULIPs Unit Linked Insurance Plan are considered to be a better investment vehicle it has failed to capture the imagination of the retail investors in India because of which of the following reasons. Direct taxes are taxes that are directly paid to the government by the taxpayer. This Act is still in force in India.

Correct option is D An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. This is a Most important question of gk exam. Key Points Tax deduction.

Which one of the following is correct according to pecking-order theory. Which of the following is not a direct tax. Options is.

Which one of the following is a direct result of a 2-for-1 stock split. A 100 percent decrease in the stock price D. Which of the following is excludable.

According to the distributive policy direct benefits are concentrated on whom. Which of the following is not a direct tax. Policy is implemented in a vacuum.

Under this Act the administration was shifted completely from the provincial. Which of the following is a direct tax. Which one of the following statements related to the static theory of capital structure is correct.

The correct answer is Rs. Facilitating import of goods. Low probabilities of financial distress E.

The tax is paid directly by the organisation or an individual to the entity that has imposed the payment. A 20 final withholding tax on interest income on bank deposits and a 5 gross receipts tax on banks is a direct duplicate taxation. All of these 5.

Firms avoid external debt except as a last resort. Direct tax is a tax directly paid to the government by the individuals or organizations on whom it is imposed. Exceptionally high depreciation expenses B.

Income Tax Act 1922 is a milestone because. Income tax is a key source of funds that the. B capital structure is irrelevant because investors and companies have differing tax rates.

Is federal income tax direct or indirect. D the value of a taxable company increases as the level of debt increases. 8 Which one of the following is a variable cost for an insurance company.

The tax must be paid directly to the government and cannot be paid to anyone else. B merchandise inventory only. One is not a direct tax A.

Very low marginal tax rate C. A tax that is imposed upon a person who is directly bound to pay it A. A rent B presidents salary C sales commissions D property taxes E amortization on the office equipment 9 For a manufacturing company direct material costs may be included in A direct materials inventory only.

These taxes are applied on individuals and organizations directly by the government. Federal income tax is a direct tax on income and not an indirect tax. There is a direct relationship between a firms profit and its debt levels.

A firm begins to lose value as soon as the first dollar of debt is incurred. Corporation tax income tax and social security contributions are examples of a direct tax. Income tax 3sales tax 4.

Which of the following is NOT true of public policy. Income tax Corporation Tax Wealth Tax etc. Income-tax MCQ Question 13 Detailed Solution.

Which of the following is a direct tax. A 100 percent increase in the common stock account balance C. These are initially paid to the government by an intermediary who then adds the.

A 50 percent increase in the number of shares outstanding E. Direct taxes are paid directly to the government. It introduced the concept of resident but not ordinarily resident.

A the optimal capital structure is the one that is totally financed with equity. The actual value of a firm continually rises in direct proportion to the increased use of debt. Indirect taxes are those applied on the manufacture or sale of goods and services.

C WACC is unaffected by a change in the companys capital structure. Which of the following is not a direct tax. Corporation tax 3sales tax 4.

A type of tax where the impact and the incidence fall under the same category can be defined as a Direct Tax. A 100 percent increase in the number of shareholders B. The linear function of a firms value has a constant positive.

-The larger society -Those who are disadvantaged -The wealthy. A tax deduction is a reduction in tax liability that tends to reduce a persons or an organizations tax burden.

Complete Guide Of Itr 1 Sahaj Form Filing For Ay 2021 22 Income Tax Return Income Tax Government Portal

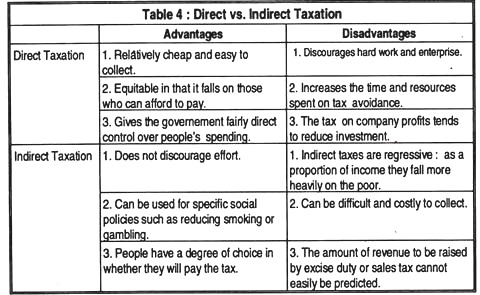

Direct And Indirect Tax Merits And Demerits Economics

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Irs Forms W2 Forms 1099 Tax Form

Direct Tax Collection 2018 19 Interesting Facts And Figures Fun Facts Facts Directions

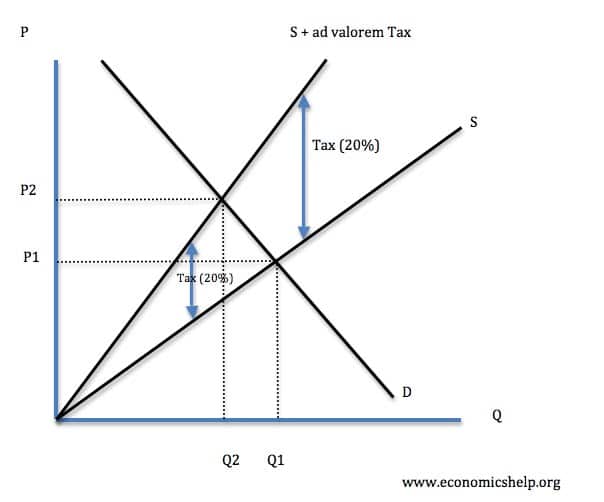

Taxation Capital Gains Tax Indirect Tax Types Of Taxes

World Law Reporter Direct Tax Amendments From 2015 16 Directions Project Finance Tax

Provision For Income Tax Definition Formula Calculation Examples

Taxes Are Going Up What Can You Do To Bring Them Down Click Here For More Information Http Bensalemcomfort Com Even Tax Lawyer Tax Preparation Accounting

Tax Types Of Tax Direct Indirect Taxation In India

Direct Taxes Definition Different Types And Advantages

Income Tax Presentation Slab Rates Income Tax Return Form 16 Types Of Taxes Etc By Mr Paresh Jain Accounting Income Tax Income Tax Return Types Of Taxes

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Money Savvy Income Tax

What Is The Difference Between Direct Tax And Indirect Tax In India

Difference Between Direct And Indirect Tax List Of Top 8 Differences

6 Ways To Verify Itr Income Tax Return Tax Refund Filing Taxes

Tax Statement Form Seven Things You Should Do In Tax Statement Form Fillable Forms W2 Forms Excel Templates

Ask In Comment Below Or Contact Us At Income Tax Return File Income Tax Contact Us

Comments

Post a Comment